The Complete Guide to Leveraging Influencer Marketing in China

Want to break into the Chinese market? Here's everything you need to know about influencer marketing in China, from finding the right influencers to creating successful campaigns.

Want to break into the Chinese market? Here's everything you need to know about influencer marketing in China, from finding the right influencers to creating successful campaigns.

Contents:

- What strategies do marketers need to employ to be successful?

- Chinese social media platforms at a glance.

- How to approach influencer casting and content in China.

- Prevalent influencer marketing challenges in China to take note of.

- A holistic approach to the Chinese market.

Influencer Marketing in China

China is a rapidly growing market with immense potential for Western brands. However, there are often several hurdles to entry, including language barriers, a lack of locally-based teams, and limited knowledge of Chinese social platforms. Despite these challenges, the Chinese market is too large and lucrative for digital marketers to ignore. Over two-thirds of Chinese consumers use their smartphones to make purchases, totaling around $2 trillion each year, and this number is only expected to grow in the coming years (Statista, 2022), (McKinsey Greater China, 2022). Western brands that can overcome these challenges and tap into this market will be well-positioned for long-term success.

What Strategies Do Marketers Need to Employ to Be Successful?

The Power of the Chinese Market

As the second-largest global economy, China's economic growth has not slowed. According to Mintel, in 2020, China's GDP increased by 2.3%, hitting an all-time high of RMB 10.6 trillion, and has continued to rise into 2021 and 2022. China's significant economic growth is due to increased spending power among the growing middle and upper classes. By 2030, 400 million Chinese households will fall into the middle and upper-class incomes – roughly the same as the US and Europe combined (McKinsey, 2021). The demographic leading this charge are Millennials and Generation Z – those born between 1980 and 2010 – who are increasingly driving spending in areas like travel, food and beverage, fashion, beauty, and luxury. These young Chinese consumers already account for 70% of the buying power of luxury market spending in China and will continue to rise (McKinsey, 2019). Companies would be wise to watch China's continued economic growth and capitalize on appealing to young consumers in these industries as their spending power grows.

Understanding the Values That Drive Chinese Consumers

Previous generations of Chinese consumers were primarily motivated by price and quality when making purchase decisions. However, Millennials and Gen Zers are much more discerning, as they are increasingly interested in brands that support sustainability, patriotism, and individuality. In recent years, sustainability has become increasingly important in consumer decision-making, especially for Millennials and Gen Zers. Brands that demonstrate a commitment to sustainability and environmental consciousness are more likely to win the business of these young consumers. However, it is not enough for brands to pay lip service to sustainability. Young consumers are savvy and can see through greenwashing. To succeed, brands must walk the talk and back up their claims with concrete actions.

Just behind the importance of sustainability for these consumers is patriotism. Years of patriotic indoctrination and China's growing global influence have made young Chinese consumers increasingly appreciative and critical of brands' localization tactics (Mintel, 2021). Subsequently, it has become essential for international brands to respect traditional Chinese, regional, and local cultures when communicating with Chinese consumers, especially as there is a growing movement towards supporting and buying from domestic brands.

Lastly, today's consumers in China face unprecedented choices when making purchase decisions as the market has become more crowded. With so many options available, Millennials and Gen Zers, in particular, seek brands that offer unique and edgy socio-cultural values to help them establish their identity. To survive in this competitive market, brands must provide desirable and well-made products and offer something that sets them apart. By understanding the needs of today's Chinese consumers, brands can position themselves to be successful in this rapidly changing market.

Chinese Consumers Are Difficult to Convert

China is home to a vast and engaged online population. With over 800 million internet users, China has the most extensive online population in the world. Those users are spending a lot of time online: according to Statista, the average Chinese internet user spends around 5 hours per day online. Much of that time is spent on Chinese apps that act as all-in-one platforms where users can book a doctor's appointment, buy a product, and talk with friends. This convenient all-in-one approach means that Chinese internet users don't need to visit multiple websites or apps to get what they need - they can find everything they're looking for in one place. As a result, Chinese internet users are highly engaged with the apps and platforms. And that engagement has translated into a massive eCommerce-based economy.

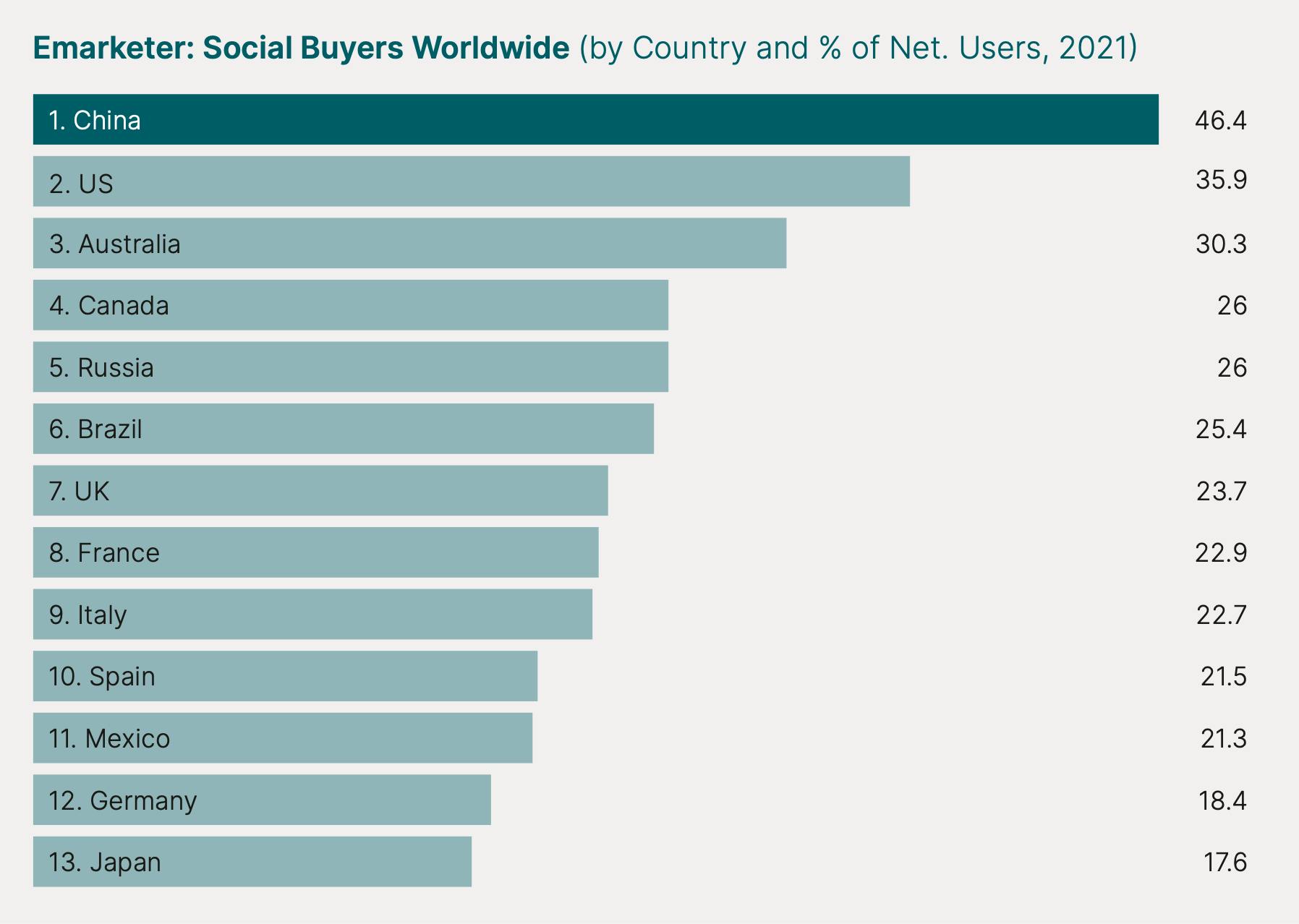

With almost half of all online transactions worldwide coming from China, it's no surprise that Chinese consumers are bombarded with ads and product choices. According to eMarketer, online retail transactions in China reached more than $2.29 trillion in 2020, with forecasts to reach $3.56 trillion by 2024. With such a large e-commerce market, Chinese consumers are warier than Westerners when purchasing. On average, Chinese consumers require nine brand touchpoints before making a purchase decision, three times more than their Western counterparts. Additionally, they also place greater emphasis on word-of-mouth recommendations from friends and family. Given the competitive nature of the Chinese eCommerce market, businesses have to work hard to build trust with potential customers.

Influencer Marketing: A Proven Solution

Chinese consumers are increasingly turning to influencers to help them make purchasing decisions due to the sheer volume of product options available and the lack of time to research them all. This problem for consumers has resulted in a booming influencer economy in China. The National Bureau of Statistics of China estimates that the total market size for influencers will reach $1,035 billion by 2025.

Several factors are driving the Chinese people's esteem for influencers:

- The need for speed and convenience has meant that many consumers look for shortcuts when making purchase decisions.

- The desire for trusted recommendations has led many people to seek out influencers they admire who are knowledgeable about a particular product or category.

- The growing popularity of social media platforms such as WeChat and Weibo has made it easier for consumers to connect with influencers, learn about new products and trends, and purchase products directly in-app.

With more and more consumers seeking out influencer advice, it's clear that the influencer economy will continue to grow in China and remains a highly effective marketing tactic for brands.

Chinese Social Platforms at a Glance

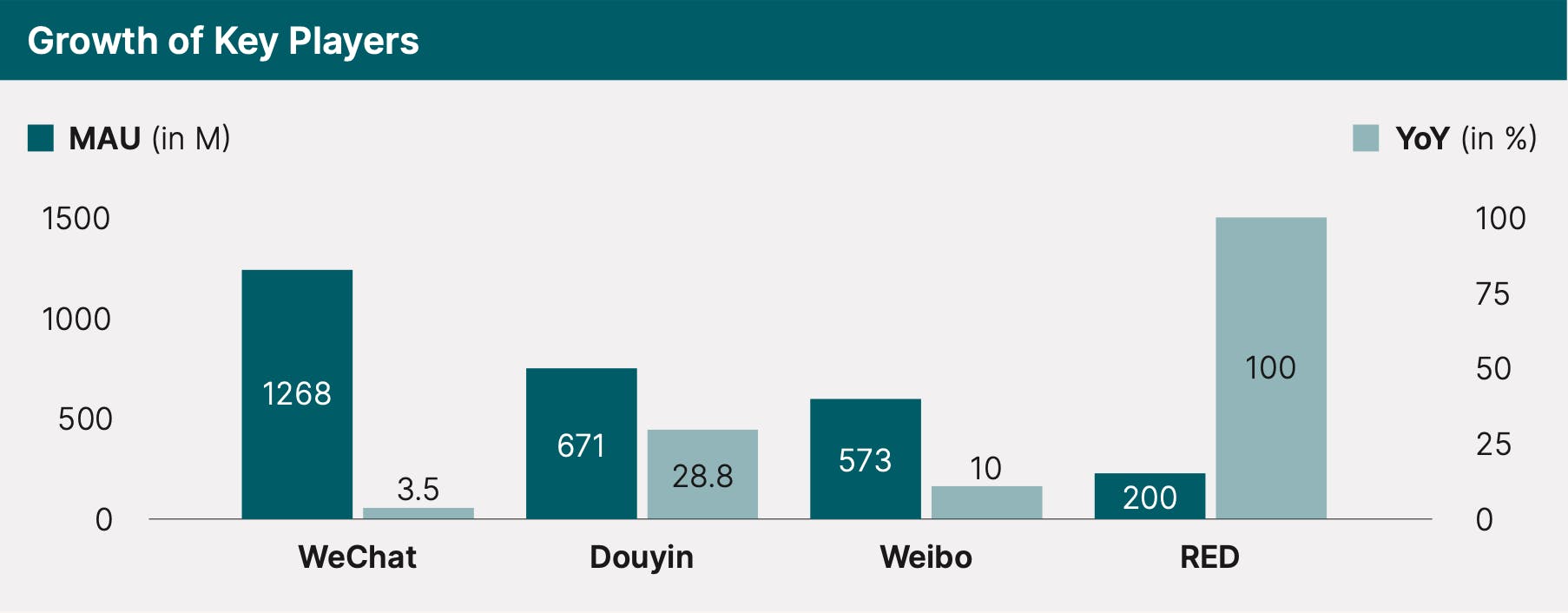

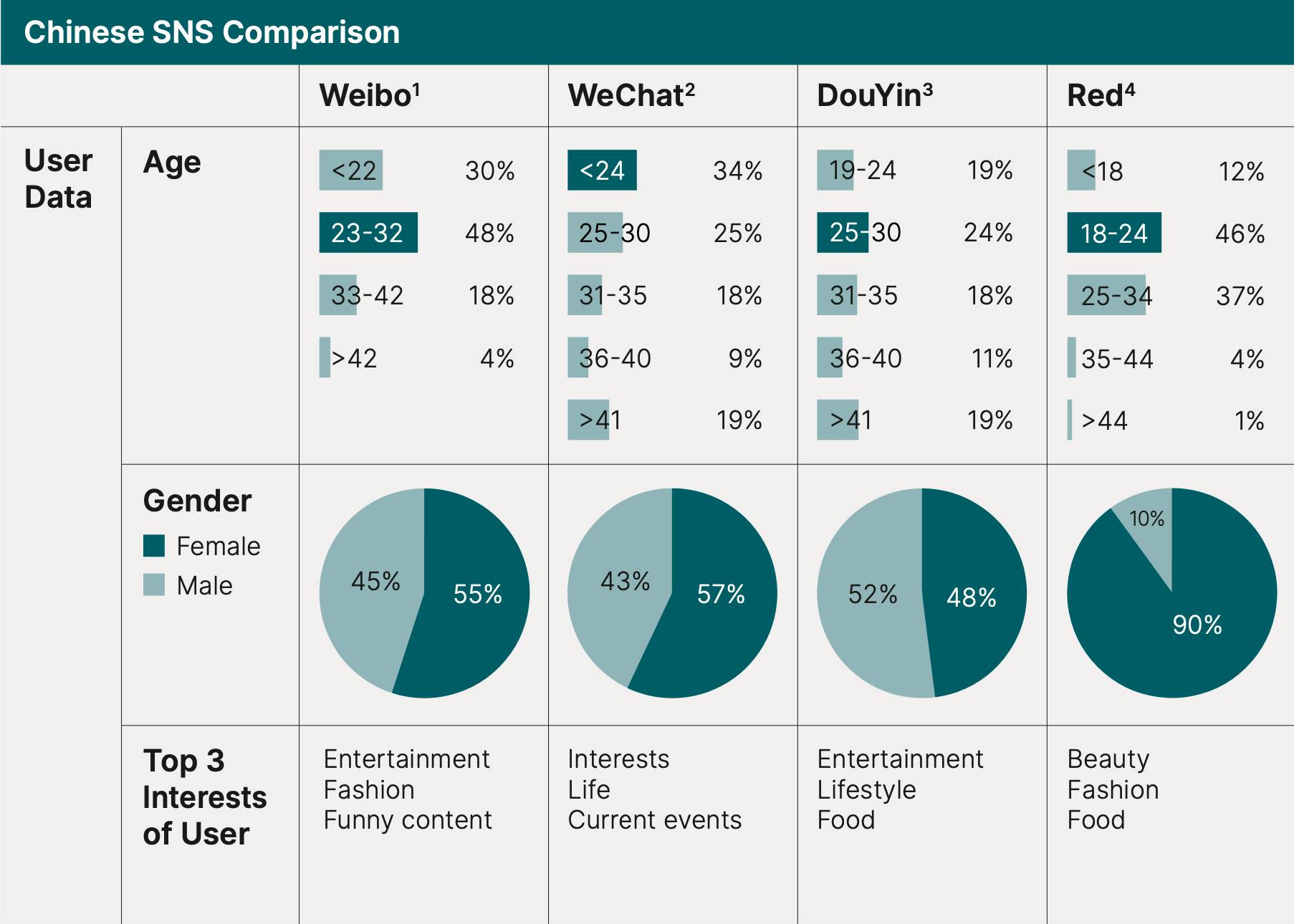

Among more than 20 social media platforms used in China, these are the 4 most popular ones:

Influencer Casting and Content in China

The Prevalence of Fake Influencers

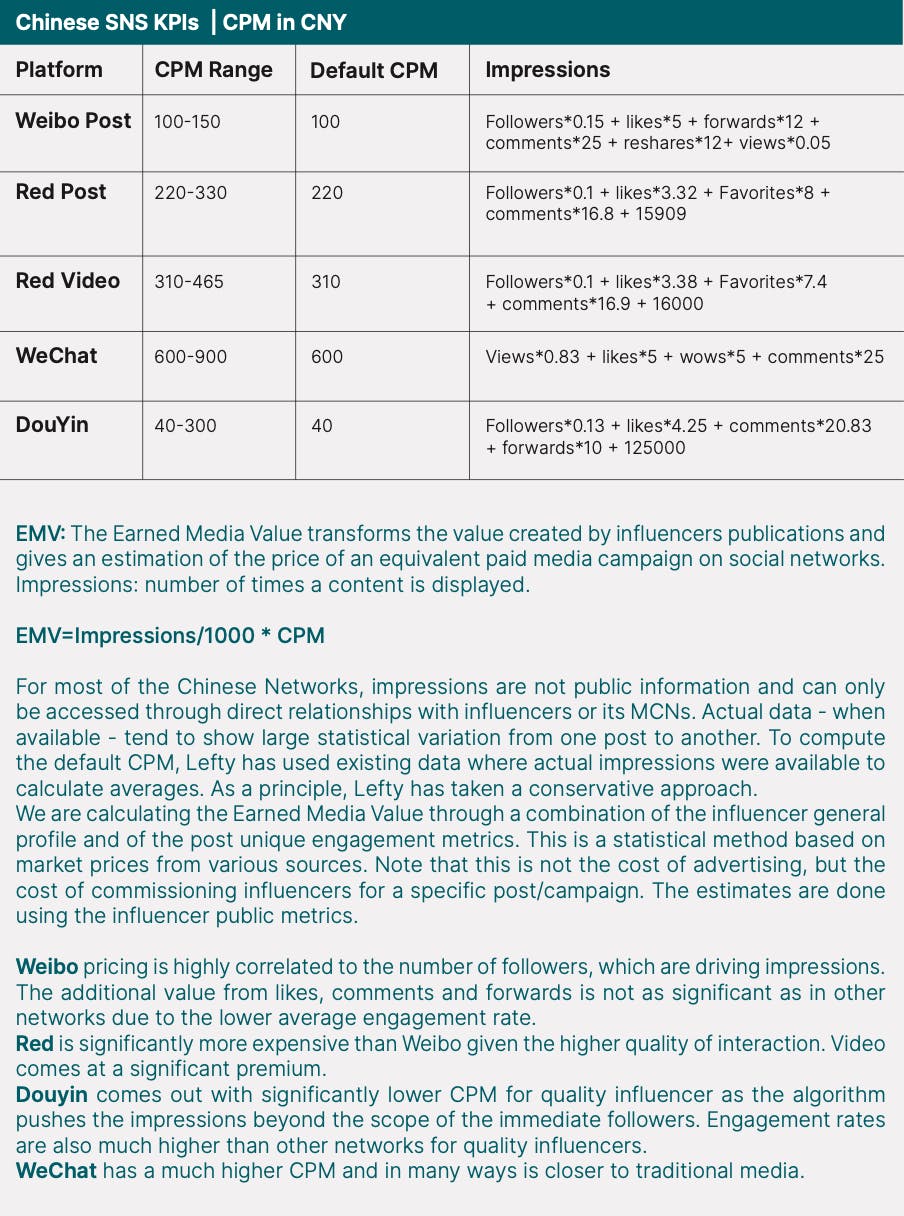

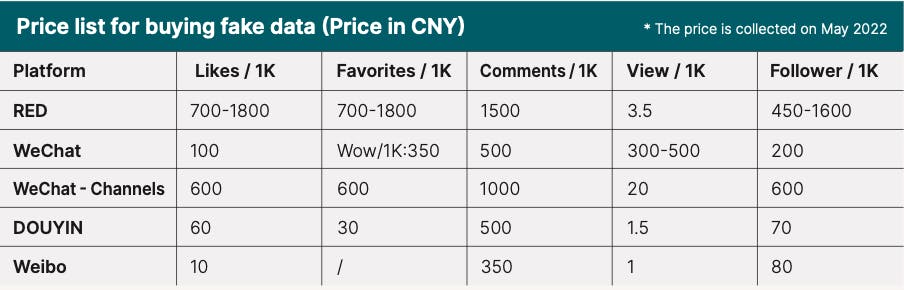

One of the most significant challenges when working with influencers on Chinese social media platforms is the abundance of fake influencers. As shown below, prices for buying engagement and followers are most accessible on Weibo, Douyin, and WeChat.Though these platforms are crucial for marketers in their influencer campaigns because of their overarching popularity, choosing an influencer with legitimate engagement and following can be challenging.

Fake influencers have caused problems for brands and users on Weibo, WeChat, and Douyin, looking for influencers with authentic voices and recommendations. As a result, Red has become increasingly popular among influencers and users. Though it's still possible to purchase fake influencers on Red, it is abundantly more expensive than on Weibo, WeChat, and Douyin, making the prevalence of imitation influencers much lower. Secondly, users and influencers alike are attracted to the idea of "authenticity" that Red promotes. The content featured on this app is typically less staged and more personal than what is generally seen on other social media platforms. Combining these factors has made Red a more attractive option for users and brands looking for authentic social media experiences and influencers.

Casting Strategy Across Multiple Platforms

When running a campaign in China, brands should invest in cross-platform campaigns to increase visibility and reach target audiences across their different preferred apps. A cross-platform campaign often involves influencer recruitment on Douyin, Red, and Weibo for most fashion, luxury, and beauty brands. This cross-platform split will usually result in a dispersion of influencer casting choices in tiers. At the top, brands will cast a couple of notable celebrities and influencers on Weibo or WeChat, as they are the most popular platforms and have high traffic levels. Next, brands will recruit several mid-sized influencers on Douyin due to the popularity of short video content and high engagement levels. Lastly, brands will cast the most significant number of influencers from Red as it is the destination for all things beauty and fashion, and influencers based on this platform have lower fees than on other apps.

What Types of Content Perform Best?

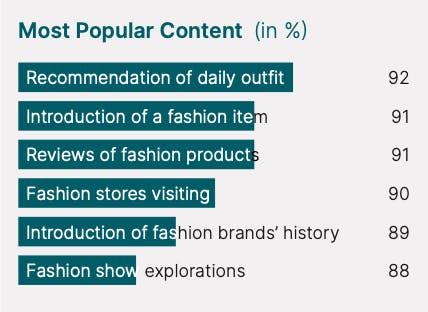

It’s no secret that social media is a powerful communication tool, and in China, short video and live-streaming formats take precedence. Chinese consumers appreciate informative and concise content due to having an overload of information available to them. According to Mintel, the most popular topics among audiences who follow fashion influencers are daily outfit recommendations, fashion item introductions, and fashion product reviews. These findings align with what we know about Chinese consumers’ general media consumption habits and why they prefer short video formats. They can learn a lot about a product quickly. With the success of the short video format in China, 70% of respondents to a Mintel study said they believe short videos are the primary source of information about what’s happening worldwide.

On the other hand, Chinese consumers prefer to watch livestreams when interested in learning more about a product or brand because of its authenticity and real-time information format. Livestreams are so efficacious in China that 88% of Mintel study respondents affirm that live streaming is a more straightforward and practical product introduction than any other advertising method. Moreover, over three-quarters of respondents said they had purchased products they saw on a live stream (Mintel, 2021). In China, potential customers want to view the product before making a purchase decision. For example, many apparel brands will host livestreams with popular fashion influencers who show viewers how to style different pieces from the collection. This type of content is much more engaging and informative than a simple photo or description, which is why it’s so popular among Chinese consumers.

A Case Study on Chinese Influencers

What Kinds of Influencers Resonate with Chinese Audiences?

When it comes to the types of influencers that consumers resonate with most, humor and trustworthiness are paramount in China. According to a Mintel survey, 57% of respondents said that professionalism was an essential trait for influencers to have. Education and experience are the most critical factors for building trust in China. Consumers with higher educational backgrounds require higher requirements from the influencers they interact with, especially academic qualifications. Correspondingly, consumers with high-income backgrounds state that industry experience is also a key factor when determining professionalism and whether or not to trust an influencer. Trustworthiness also comes into play when considering the content an influencer produces. For example, if an influencer promotes a product with little relevant experience, this endorsement will likely damage their reputation and reduce consumer trust. When choosing influencers to work with, brands should consider those with a mix of academic credentials and real-world experience to build trust with their target audiences.

Beyond trustworthiness, humor is always a critical factor in building resonance with Chinese audiences. Chinese consumers appreciate influencers who can make them laugh, with 54% of respondents to a Mintel survey stating that they look forward to seeing posts from funny influencers. Furthermore, Mintel’s research shows that nearly half (46%) of social media users in China follow “funny people” online, outranked only by those who follow “people like me” (52%). In other words, it pays to be funny if you’re looking to build a rapport with Chinese consumers. And while Western brands have often shied away from humor in their marketing efforts, China provides ample opportunity for brands willing to take the plunge. Influencers considered trustworthy and funny build dedicated fan bases, such as two of China’s most popular influencers: Li Jiaqi and Becky Li.

Li Jiaqi, the "King of Lipstick"

In the beauty world, the most well-known Chinese influencer is Li Jiaqi or Austin Li, who is known as the “King of Lipstick” in China. Li Jiaqi hosts regular live streams and posts videos on Douyin, where he has over 44 million followers. Li Jiaqi’s rise to beauty fame comes down to his soft boy-next-door personality and his penchant for authenticity – unafraid to call out even the most prolific beauty brands when he doesn’t like their products. Li Jiaqi has built an incredibly loyal audience that fully trusts his recommendations based on these factors. As a result, on 11/11 or Singles’ Day (China’s largest annual shopping day) in 2021, Li Jiaqi sold $1.9 billion worth of products (South China Morning Post, 2020).

Recently, LiJiaqi discontinued his daily broadcasts on Douyin on June 4th. The decision came after one of his live streams was cut short due to the appearance of a cake shaped like a tank, referencing the 1989 Tiananmen Square crackdown. LiJiaqi risks being banned from the platform by ceasing his broadcasts – a fate other major influencers have commonly faced.

Becky Li, the "Goddess of Shopping"

One of the most well-known fashion influencers is Becky Li, who is most active on WeChat and Weibo. Becky Li regularly posts blog-like fashion and lifestyle content on both WeChat and Weibo to her 5.2 million followers. She earned the title “Goddess of Shopping” after collaborating with Mini Cooper and selling 100 of their cars in 5 minutes on WeChat (South China Morning Post, 2018). As a former journalist, Becky Li's content has established strong ties between her and her audience due to her approachable online persona and well-written content. Consequently, Becky Li is well known for her dedicated fan base and salesmanship skills when partnering with brands.

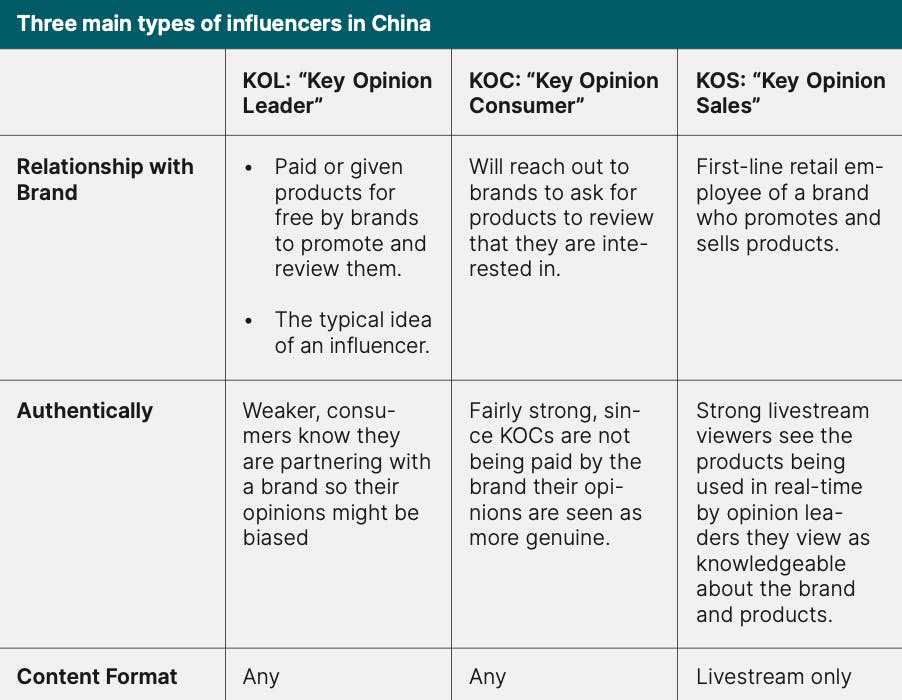

Different Types of Influencers in China

While Westerners might be accustomed to the typical social media influencer, China has a different landscape for online personalities. In addition to the more traditional influencer or Key Opinion Leader (KOL), there are also Key Opinion Consumers (KOC) and Key Opinion Sales (KOS). KOLs in China tend to follow the traditional influencer role like their Western counterparts, but they often have a more niche focus. For example, a KOL might focus on skincare or fashion only. Because of their niche focus, KOLs are considered experts in their field, and Chinese audiences highly respect their opinion. Brands will often partner with KOLs to promote or review their products. Though sponsored content is not as trusted as authentic content, Chinese audiences still respond well to KOLs.

KOCs, on the other hand, are typically people who have amassed a following because of their unique or trusted insight into an industry or product category. They are not opinion leaders with a large following but have extremely loyal audiences, giving them significant influence. KOCs typically approach brands and ask to have a product sent to them that they are interested in reviewing. KOCs will then review the product and share their opinions with their audiences across platforms. Though KOCs typically have smaller followings than KOLs, their views significantly impact their audience’s purchasing decisions and brand preferences.

Challenges in China to Take Note of

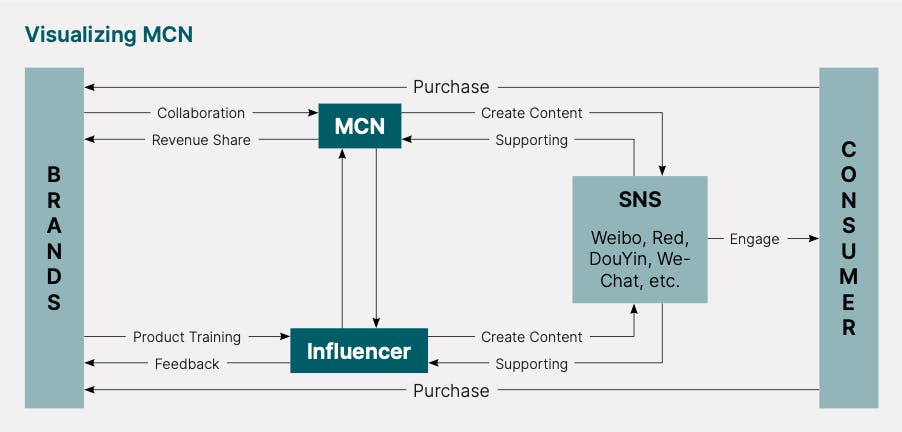

What is an MCN?

MCNs play an outsized role in the Chinese social media landscape, and understanding how they operate is essential for any brand looking to work with influencers in China. Unlike in the West, where influencers are predominantly independent or have a manager, most Chinese influencers are under contract with executive agencies called Multi-Channel Networks or MCNs. The MCN-influencer relationship usually starts with the agency recruiting already established influencers and influencers on the rise and helping them boost their followings by employing a professional team of content producers. In return for their investment, MCNs take a cut of the influencer's earnings from sponsorships and other commercial deals – which are approved through the MCN, not the influencer themselves. As a result, MCNs can wield significant power in decision-making around an influencer's career.

MCNs are prevalent in China, with an estimated 20,000 working MCNs in 2019 alone (Marketing China, 2022). Working with MCNs helps social media platforms focus on the business management of their networks rather than the brand/influencer sponsorship side. MCNs also help drive traffic by employing their influencers on up-and-coming social platforms and increasing their profitability. It isn't easy for influencers to start a career organically without the help and promotion of MCNs, making the whole organization symbiotic and essential for anyone looking to partake in influencer marketing in China.

Working in Partnership with an MCN

If a brand is interested in working with an MCN, it should start by researching which MCN would be the best fit for them. This includes looking into the size of the network, the types of influencers in the network, and any case studies or reviews from other brands. Once a brand has found an MCN that meets its needs, it will work with the MCN to select influencers and create content. The MCN will also help to manage the campaign and track analytics. Though working with an MCN is more efficient than directly with influencers, there are some downsides to consider.

One potential downside of working with MCNs is that they can be biased regarding the influencers they choose for brands' campaigns. Since the network's stake is on the line instead of the influencer's, MCNs will often inflate their performances in campaigns. This can be misleading for brands looking to accurately picture an influencer's reach and engagement. MCNs have also mistreated their influencers by not paying them enough or setting unfair standards. This can create a negative association with a brand if word gets out that they are working with an agency that treats its influencers poorly. Lastly, MCNs can often incorrectly cast influencers for brands' campaigns by selecting influencers with large followings but low engagement rates. This can lead to wasted budgets and disappointed customers. Therefore, brands need to research before working with an MCN to ensure they are partnering with a reputable agency.

Agencies and Lack of Data Transparency

While some Western brands have decided to forgo the complexities of entering the Chinese market and instead partner with agencies to help them, this model does not come without challenges. One of the biggest dangers of working with an agency is a lack of data transparency. Because influencer marketing in China is still relatively new to Western brands, many don't have the internal knowledge or resources to understand what's happening on the ground. As a result, they rely heavily on their agencies to provide accurate and up-to-date information about the progress of their campaigns. However, because agencies are aware that their clients don’t understand the Chinese digital marketing landscape, there is a risk that they will not be transparent about the data to keep their clients happy. For brands looking to partner with an agency to enter the Chinese market, it is essential to do your due diligence and ensure that you are working with a trustworthy agency and understand the basics of the influencer marketing landscape in China.

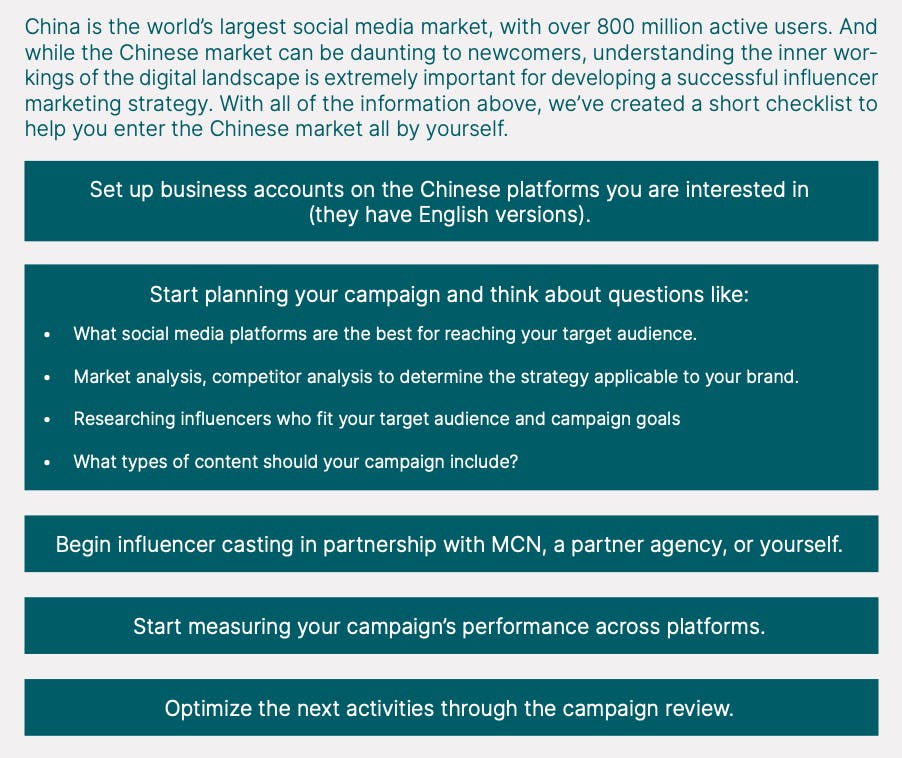

A Holistic Approach to the Chinese Market